Contractors, Autumn Budget 2025 is set to extend the big income tax freeze

It very likely wasn’t her rumoured July 14th cuts to the cash ISA allowance that brought her to tears at a recent Prime Minister’s Questions, writes Angela James, founder of Yolo Wealth.

But unfortunately, Rachel Reeves looks set to make an arguably even more miserable decision in the eyes of contractors, albeit invariably not until Autumn Budget 2025 at the earliest -- extending the freeze to income tax thresholds beyond tax year 2028/29.

The Angela Rayner memo cues up Autumn Budget 2025 extending the income tax freeze

It's perhaps a little early for the Autumn Budget rumour mill to hit full pelt yet, particularly given it feels like we’ve only just finished celebrating the Summer Solstice!

You can blame a leaked tax memo in May. Sent and written by deputy PM Angela Rayner to Reeves, the memo was, in effect, a raft of new suggested revenue raids.

One of the many mooted was a prolonged freeze on the additional rate tax threshold. This threshold is currently £125,140, after which income is taxed at 45%.

What is the income tax threshold freeze? It’s stealth tax; and here’s why

Income tax thresholds are the levels of income we can earn, and in turn, the level of tax is payable. These thresholds historically would increase each new tax year, usually in line with inflation.

But here’s the painful rub. All thresholds have been frozen since 2022/2023 by the previous government, when they were initially frozen until the 2025/2026 tax year.

The ‘big freeze’ was further extended by Jeremy Hunt, when he was chancellor, and he extended this ‘stealth tax’ until April 2028.

What has Labour actually said about income tax?

Reeves previously stated at Spring Statement 2025 that the Labour government would not extend the income tax freeze; they would merely maintain the freeze until April 2028.

That might not sound all that bad. But keep in mind, that’s the government saying they will keep the UK’s tax burden at a 70-year high! That burden equates to 37.7% of GDP.

At her first Spring Statement, Reeves signalled that after April 2028, all the thresholds would receive future increases. That policy intention was, the chancellor implied at the time, designed to meet the Labour party’s pre-election commitment not to raise taxes on “working people.”

How’s your money working out for you, working people?

The big income tax threshold freeze, which the bookies say is about to get even bigger once Reeves gets to her feet in the autumn, can make contractors feel like they’re not seeing an improvement in their tax position.

It can feel like Labour isn’t uplifting flexible, “working people” out of tax, for potentially small exchequer gains.

How much will Reeves raise from further freezing income tax thresholds?

But actually, the big income tax threshold freeze raises significant revenue for the government -- this expected extension of the freeze, alone, albeit beyond April 2028, is calculated to net £8billion a year.

It’s a hefty sum because, as most working people see increases to their earnings each year, the effect is to uplift more people into higher tax thresholds -- higher payments to HMRC -- than they may have seen (had tax thresholds increased year-on-year).

So it’s hardly a minor thing.

Furthermore, according to the OBR, an estimated extra 8.3 million people will be affected by this fiscal drag -- or ‘stealth tax’ in the shape of the big income tax threshold freeze -- between now and the 2029/2030 tax year.

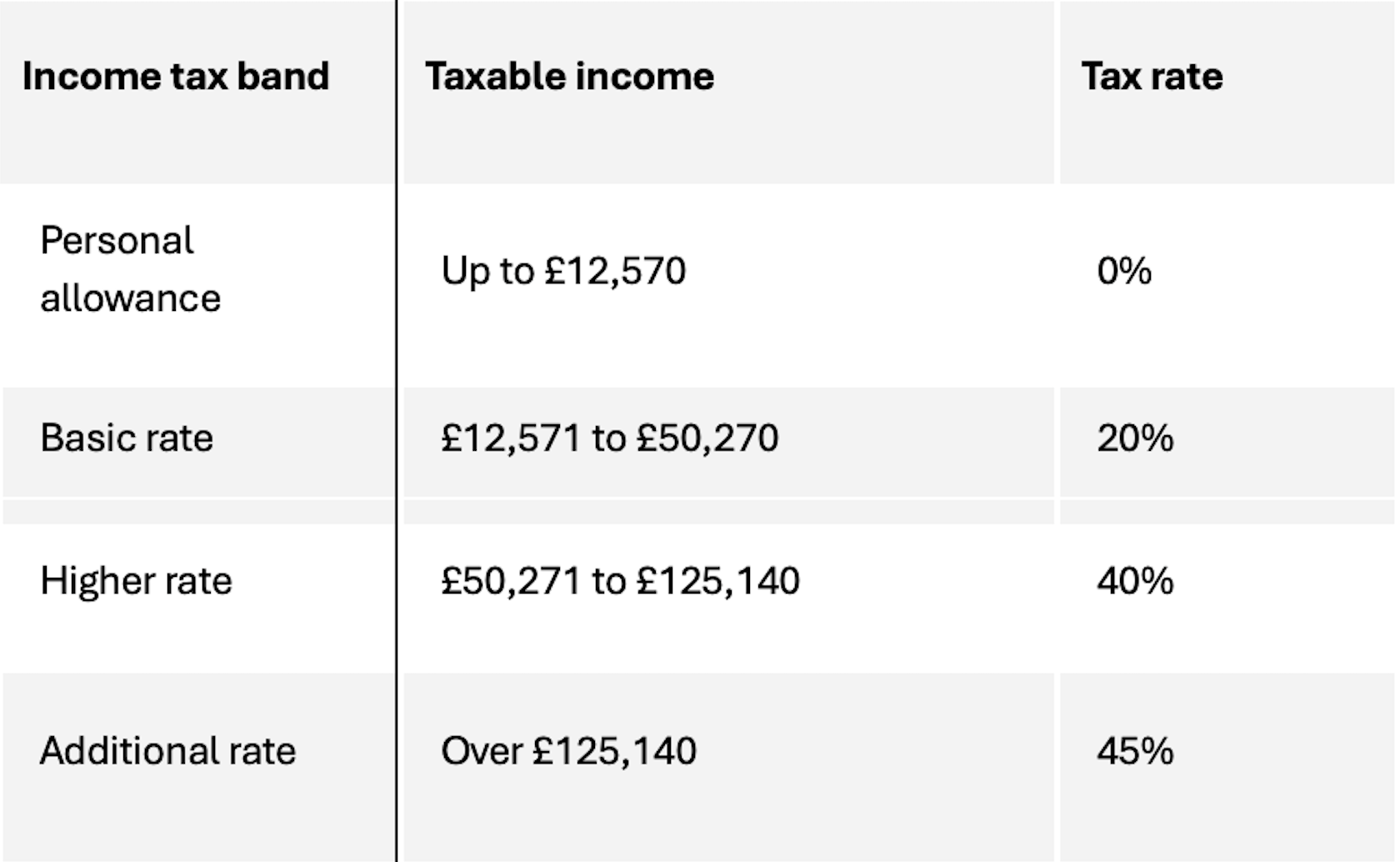

Income tax thresholds table

Below is a reminder of the current thresholds.

The Bank of England (BoE) just dropped an ‘over-interpreting’ alert

The OBR’s stats come as Andrew Bailey, the governor of the BoE, recently warned against “over-interpreting” forecasts from the Office for Budget Responsibility (OBR).

Well, coupled with the reportedly already signed-off ISA raid, it won’t take contractors much interpretative time to deduce that they cannot be the “working people” that this chancellor has in mind.

The additional rate threshold rub for inside IR35 contractors

Further, keep in mind, since April 6th 2023, the additional rate threshold was reduced from £150,000 to £125,140. The reduction brought even more of our contracting community, particularly those working inside IR35 contracts, into this pricey bracket.

For higher-earning contractors, you also have the consideration and additional tax created by the loss of your personal allowance (the ‘tax-free’ income allowance).

A quick reminder on the personal allowance at the additional tax rate for those who aren’t sure what this means.

With earnings over £100,000, how does the personal allowance clawback work?

For every £2 earned over £100,000, the tax-free personal allowance is reduced by £1. So, if you fall into this additional rate band, this means you earn over £125,140 and therefore have £0 tax-free personal allowance.!

The ‘bottom line’ I keep coming to when crunching the numbers for my contractor clients is that Reeves potentially 'bigging up' the already 'big' income tax threshold freeze will very likely mean that more and more contractors suffer from the additional rate raid.

Day rates will invariably start to fall into this rate of tax over the coming few years, imposing the extra tax that comes with it.

What can contractors do to fight the big income tax freeze at the additional rate?

As the contractor community know more than most, what decisions the government makes, we have very little control over!

But contractors can take advantage of other policies, allowances, thresholds and tax breaks to be more effective with their income.

In short, contractors more than ever need to make full use of any other allowances they have available.

Ahead of Reeves’ suspected income tax threshold freeze at Autumn Budget 2025, try pensions…

One effective way to reduce your taxable income, i.e. the tax legally payable to HMRC (and possibly restore your personal allowance or reduce your taxable threshold too), is to consider pension contributions.

Pension contributions attract tax relief at your highest marginal rate, so if you are an additional rate taxpayer, then this is your effective tax relief. This could be as high as 60% if you can restore some or all of your tax-free allowance as well.

Only time will tell if the government backtracks on its pledge to restore increases to tax thresholds. Or if they’ll maintain the big freeze or just hold the freeze on the additional rate.

Don’t settle for a generalist adviser across your contractor personal finance affairs

If you are concerned that you may have already fallen within these thresholds, or could be soon, then it would be prudent to explore your options with a financial adviser. My tip? Enlist one who specialises in a contractor’s financial affairs. If you don’t have a dedicated adviser, I offer an initial consultation at no fee to discuss your individual circumstances. And that’s not to be sniffed at in the era of punishing stealth taxes and audacious ISA raids!

=

Approver Quilter Financial Services Ltd 19/08/2025.

The value of investments and the income they produce can fall as well as rise. You may get back less than you invested.

Tax treatment varies according to individual circumstances and is subject to change.

Investors do not pay any personal tax on income or gains, but ISAs may pay unrecoverable tax on income from stocks and shares received by the ISA managers. Tax treatment varies according to individual circumstances and is subject to change.

Stocks and Shares ISAs invest in corporate bonds, stocks and shares and other assets that fluctuate in value.