Starling Bank: business account for contractors

Join over 500,000 UK businesses, and apply for a free business bank account in minutes, from your phone.

Business account & sole trader account

We’re recommended by 82% of business customers – no other bank is recommended by more. And here’s why:

- Absolutely no monthly fees or UK payment charges

- 24/7 customer support from our UK-based teams

- Real-time integration with Xero, Quickbooks and FreeAgent

- Instant notifications when you spend or get paid

- Track spending, and upload receipts to transactions

- Saving Spaces and Bills Manager make managing money easier

- Earn 2.5% interest (AER) on savings with a 1-Year Fixed Saver

- Deposit cash at any Post Office branch for a 0.3% fee, and deposit cheques in the app just by taking a photo

- An easy-to-use app that just works, and a desktop portal too

- Access to free business guides written by experts

- Your money is protected up to £85,000 by the FSCS

Banking and bookkeeping all in one place

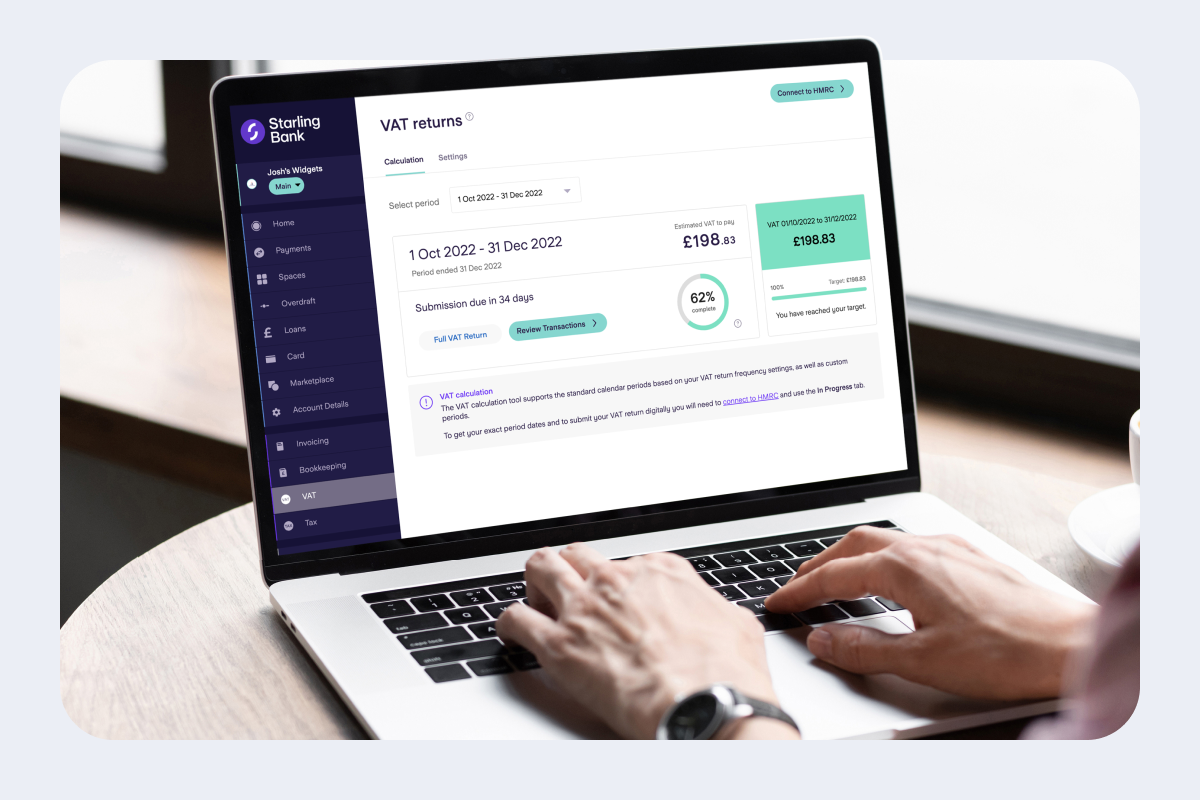

Starling’s Business Toolkit lets you manage invoices, bills, tax and VAT from your bank account:

- Seamlessly create and send invoices directly from your desktop. Quickly see what’s owed to you and, when you get paid, just match your invoices in a single click.

- Record VAT on your transactions, and set defaults if you’re happy to automate some of it. Connect to HMRC and submit your returns through Making Tax Digital.

- Create Savings Spaces for VAT and tax directly from Toolkit. These Spaces automatically compare your tax estimates to the amounts you have set aside for them

- Toolkit is free for your first month, and then costs just £7 a month. You can cancel at any time.

Business, euro, USD, personal, joint and even kids: we’ve got a whole host of accounts ready to go. And they’re all seamlessly managed from the same app.

Connect to accounting software in real-time

Connect your Starling account to accounting software, payments platform, pension provider and more with Marketplace:

- Share your banking data with Xero, QuickBooks and FreeAgent securely, automatically and in real-time. For free.

- Link to leading point-of-sale platforms, Zettle by PayPal and SumUp. Get detailed summaries on transactions, fees and VAT.

- Make life easier by connecting to pension providers, HR platforms, legal help and insurance brokers.

It's showtime.

Here’s everything you’ll need to apply for an account:

- A smartphone (and signal)

- Valid photo ID such as a passport or UK driving licence

- You'll need to be a sole trader or the Person with Significant Control (PSC) of a Limited Company (LTD) or Limited Liability Partnership (LLP)

- About 10 minutes of your time (if you have documents which confirm the nature of your business at hand this will be easier)

- If you already have a personal account and want to open a business account or sole trader account, simply click on the button in the top right hand corner of the Starling app, select your personal account and then click ‘Open a new account’

When your account is open, use the Current Account Switch Service in app to move all your money, Direct Debits and standing orders over in one go.

Business banking shouldn’t cost the Earth

We’re a paperless bank, which means we won’t send you paper statements or chunky welcome booklets and our debit cards are made from recycled plastic.

What Starling customers say: