Status Determination Statement: off-payroll explainer for April 2021

For all that the contractor sector now knows about the fast-approaching off-payroll framework, two of the key requirements of the new IR35 legislation from April 2021 still seem to be shrouded in mystery.

These are the main legislative obligations placed on end-client businesses: the production of a Status Determination Statement (SDS), and the implementation of the end-client’s own in-house “Disagreement Process.”

These obligations will also be placed on public sector end-clients when the legislation comes into force on April 6th 2021. So it’s high-time to demystify both and I will do that here, exclusively for ContractorUK readers in this three-part series, which will include a final refresher of the legislation, writes David Harmer, associate director at Markel Tax.

First, let’s start on a positive. Although a change in legislative requirement from April if you’re limited company contracting in the public sector might seem burdensome, our expectation is that most contractors will welcome the addition of both the SDS and Disagreement Process, because contractors have struggled under the existing public sector IR35 legislation, effective since April 2017.

SDS: in a nutshell

The legislation places three requirements on the SDS itself:

- It must confirm whether an engagement is within IR35 (subject to tax and NI) or outside of IR35 (akin to self-employment).

- It must provide an explanation for this decision.

- It is only valid if the end-client business has taken ‘reasonable care’ in arriving at that decision.

The legislation does not specify how this statement must be laid out; it does not legislate the tests for employment or self-employment (i.e. how to decide if IR35 applies), and it does not provide any definition of “reasonable care”.

However, the Employment Status Manual (at ESM10014) does set out HMRC’s interpretation of reasonable care. Still, one has to remember that is only HMRC’s interpretation, which is not the same as a requirement enshrined in legislation.

The legislation further obliges that the client must provide the SDS to the party it contracts within the supply chain and to the worker of the limited company at the bottom of the chain.

Importance of providing the SDS

The legislation obliges the end-client business to provide the SDS. Until the end client has issued the SDS to the worker and to the next party in the chain, then it is the ‘fee-payer’ for the purposes of the legislation, and is responsible for all potential liabilities associated with being the ‘fee-payer.’ ( This term will be covered and explained in part three, the final refresher). The SDS must be passed to both parties, and it must have been produced with “reasonable care” before the end-client is released from this burden.

Effectively, in respect of the passage of SDS down the contractual chain, the legislation places the holder of the SDS as the “bearer of liability”. This can have significant consequences for more complex contractual chains.

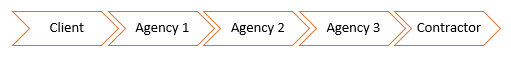

For example, if we take the following contractual chain:

Looking at the chain, the obvious conclusion is that the client must make the decision and Agency 3 is the fee-payer. But it’s not that straightforward. The client in this chain must pass the SDS to Agency 1 and to the Contractor. If it does not, then it is the fee-payer. In turn each Agency in the chain must pass the SDS to the next party. Agency 1 remains fee-payer until it passes the SDS to Agency 2; Agency 2 will remain fee-payer until it passes the SDS down to Agency 3.

The legislation does not contemplate the additional hurdles of more complex contracting chains such as this, it simply provides that the SDS must be passed down.

What is reasonable care?

Broadly speaking in the world of tax, ‘reasonable care’ means taking actions and decisions which are not careless, reckless or deliberately false. Without delving too deeply in to the thin lines which separate reasonableness and unreasonableness, in the context of IR35 decision-making we can conclude that to be certain ‘reasonable care’ is being taken, one must examine the contracts and the working arrangements of each contractor, and have an understanding of the law which determines whether or not IR35 applies. HMRC’s view on the amended legislation appears to be similar, but they do make the point that they would expect better compliance from say a ‘Plc’ than they might from a medium-sized business without its own legal department.

Nevertheless, ensuring compliance will not be a small feat for end-client businesses, and we have seen a number of actions taken by end-clients over the last twelve months, including:

- Blanket decision not to use PSC contractors

The decision not to use limited company contractors takes the end-client business outside the scope of the legislation entirely – if no limited company contractors are engaged then there are no legislative requirements to comply with. This action is most prominent in the banking sector.

While this action eliminates the IR35 risks, we consider there may be real commercial difficulties for businesses that take this route, as contractors may seek work elsewhere (we saw a similar reaction when the false self-employment legislation [s 44 ITEPA 2003] was introduced in 2014, only for end-client businesses to make a U-turn some 9-to-12 months later).

- Blanket “caught” decisions

In our opinion, this leaves the end-client business with significant problems, as this would likely fail the ‘reasonable care’ requirement. One of the overriding principles in law, and from every employment status and IR35 decision, is that each case must be decided on its own merits, based on its own facts. If a blanket decision is used, without clear consideration of each contractor’s terms and working practices, then this simply does not comply with the legislation. ESM10014 makes the same point.

- Outsource compliance to third party companies

This can be an attractive proposition for end-client businesses, and seeking third-party specialist advice should satisfy the ‘reasonable care’ requirement. Care, however, must be taken when choosing a third party – HMRC and the courts are unlikely to be satisfied simply by the appointment of a third-party business. They will expect the end-client business to demonstrate that it has undertaken its ‘due diligence’ and assessed whether the third party ‘specialist’ is indeed an IR35 specialist with the requisite skills and knowledge to produce the SDS on the end-client’s behalf. If ‘reasonable care’ has not been taken in making the decision, it is the end-client, not the specialist, who will be held accountable by HMRC for not having produced a correct SDS.

Reasonable care issues aside, if that third-party is also tasked with supplying the SDS and dealing with the disagreement process (explored in part two), end-clients must be made aware that if the third-party does not supply the SDS to the correct parties or does not deal with the disagreement process correctly, then it is the end-client, not the third-party specialist, who will be accountable under the legislation.

These are just the three most common areas we have identified. A number of end-client businesses are already in discussions with us and other specialist advisers, to obtain training in IR35 to enable them to deal with the legislative obligations in-house.

What should an SDS look like?

As mentioned above, the legislation does not give a prescribed format and while HMRC has provided guidance on the applicability of the legislation, and has developed its CEST tool further, no detailed guidance has been provided on any on what form a SDS should take.

HMRC’s guidance simply restates the legislative obligations and directs end-client businesses to keep ‘adequate records’ of decisions.

In the run up to April 2020 (when the IR35 reform was expected to be introduced from), we saw a variety of SDSs in varying formats and length. And while for the most part they all complied with legislation, some were basing decisions on generalities and not on the specifics of the engagement. It is clear that some guidance is needed to ensure not only that the SDS complies with the legislation, but also that the contractor understands the decision. In our opinion, an SDS should contain:

- A clear statement that the engagement is inside or outside IR35

We would recommend that at the top there is a clear, standalone statement which says either “We have determined this engagement is outside of IR35,” or “We have determined this engagement falls within IR35.”

It should be immediately clear to the contractor and the agency what the decision is without any ambiguity and without having to read through an entire report to find the decision. This way, end-clients can be certain it has been read and understood.

- A clear explanation

Our advice is that end-client businesses must remember their audience. An explanation on why the decision has been reached does not need to be “War and Peace”-style in its length and complexity. And it does not need to reference every IR35/status case that has ever been heard!

In simple terms it should explain what factors were considered (the law directs us to Personal Service, Mutuality of Obligation and Control as fundamental factors, as well as ‘In-Business’ factors – we would suggest this is a good starting point). And it should explain how the contracts and working practices demonstrate that the legal requirements have/have not been satisfied.

It can be tempting for end-client businesses to provide a lengthy SDS for cases where the engagement is outside IR35, and a shorter explanation for engagements that are within IR35 (with the mindset that HMRC will only be interested in the ‘not caught’ decisions so these should be more detailed). We would caution against this as it might be arguable that HMRC may not be interested in the detail surrounding a “caught” decision, but the contractor definitely will be and they will be the first person who is receiving this. A thorough explanation should be provided to the contractor, regardless of the determination. If the contractor does not understand the reasoning behind the decision, then it can lead to much more time and expense for the end-client if the contractor disagrees with the decision and challenges it.

- What the decision means

It may seem absurd to think that contractors or agencies don’t know what the consequences of IR35 are, but it is better to be safe than sorry. This is more so because many companies and advisers use different terminology “caught”, “not caught”, “employed”, “inside”, “outside” among others. It is advisable, therefore, to overstate the consequence of the decision that has been made. Perhaps something along the lines of: “This means the money paid to [limited company] must be subject to Tax and NI at source.” Alternatively, “this means the money paid to [limited company] can be paid gross and is not subject to Tax and NI at source.”

- Details of the disagreement process

Under the legislation the end-client is obliged to implement their own Disagreement Process (which will be explored in more detail in part two). We would recommend that the SDS also includes a statement which directs the contractor to a point of contact if they do not agree with the decision. While this is not a requirement of the SDS itself it, the Disagreement Process is subject to legislative time-limits which could become difficult to manage if contractors are not given one central point of contact.

When should the SDS be sent?

In short, from April 6th 2021 end-clients should issue the SDS as soon as is practically possible. Ideally this would be before the engagement begins, because until the SDS is produced and sent to the correct parties, the end-client business is in the frame for any potential liability as the fee-payer.

For engagements which start on or before April 6th 2021, HMRC have confirmed that an SDS produced and sent to the correct parties prior to April 6th 2021 will comply with the legislative requirements, meaning effectively an end-client can dispose of their obligations in advance of April 6th.

Finally, clients ought to note however, and contractors should beware that an SDS must be produced for every engagement, meaning that if there is a change in working practices or contracts then a new SDS must be produced.

In part two, we shall consider the client-led IR35 Status Disagreement Process, ahead of a refresher of the legislation (part three), which will cover some key terms and liability issues from April 6th 2020.