How investors can beat the mortgage relief clawback

Our first and second piece on the clawback to income tax relief that property investors can claim on mortgage costs didn’t stem the tide of questions. This is fitting-- we’ve got not two, but three workarounds to the clawback and this third piece illustrates them, writes Sat Singh, chief executive of IFAs ContractorMoney.

What’s changing from this time next year

To recap, from April 6th 2017 finance costs will no longer be a tax-deductible expense for any individual buy-to-let investor; novice or serial. Instead, people who own a property for investment, whether it be their wife's old flat or portfolio property number six, will receive an effective tax relief on their finance costs only up to the basic rate of income tax at 20%.

‘So what?’ the uninitiated might ask. Well, currently the full amount of mortgage interest payments which are incurred ‘wholly and exclusively’ for the purpose of letting property can be deducted from the rental income received to reduce the taxable profits. Landlords can also claim for other allowable deductions such as insurance, ground rent, renewals, management fees, rates and professional fees. These deductions reduce the rental income liable for income tax, where the property is under personal ownership.

But from April 6th next year, landlords with a taxable income inclusive of the gross rental income, in excess of the higher and additional rate tax thresholds, will be required to pay the difference between their marginal rate and the basic rate, effectively equating to a hefty 20% or 25% tax on the finance costs of individually owned buy-to-lets.

Who’s affected

It is expected that property investors with low-yielding properties, particularly those in the south of England and London, may see the tax they pay on their finance costs exceed their rental profits. But actually the clawback is considerable wider in scope -- it will affect any landlord who owns their buy-to-let(s) individually, through a limited liability partnership or a simple partnership.

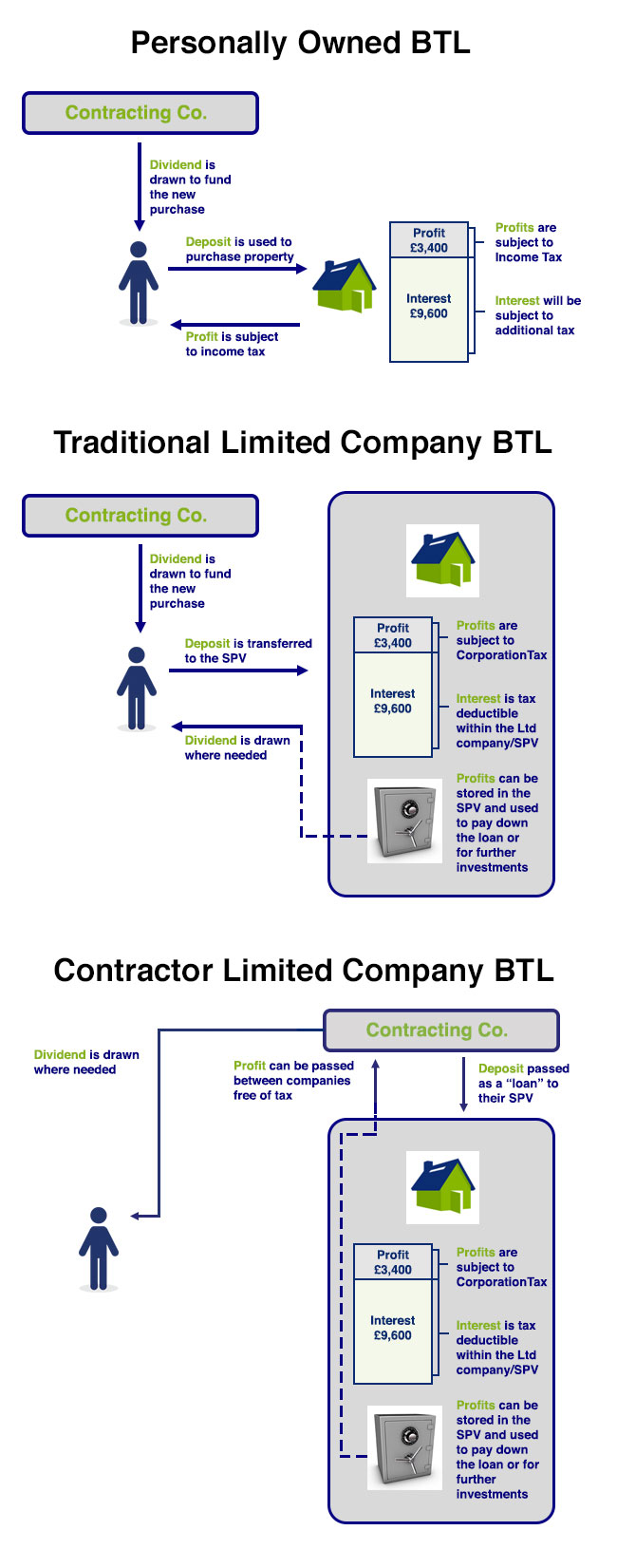

As shown in the below illustration, properties owned through a limited company are not caught by the incoming reduction. The other positive in the eyes of contractors is that the reduction in tax relief will be phased in over a period of four years (rather than happening all at once), to help minimise the impact on investors.

Three workarounds

Whether you currently own your own limited company or not, there are typically three set-ups you can choose from to get around the reduction. Whichever one you go for, it should be made clear -- a limited company really is the only way to continue fully deducting your finance costs against rental income.

Notes to the workarounds

- Under the first set-up (Personally Owned Buy-To-Let), the deposit must come from the landlord’s own funds (usually requiring a dividend to be drawn).

- The rental profits in this set-up are subject to the landlord’s highest marginal rate of income tax.

- The mortgage interest in this set-up will be subject to additional tax at 20% for HRT and 5% for ART.

- Under the second set-up (Traditional Limited Company Buy-to-let), the deposit must come from the borrower’s own funds (usually requiring a dividend to be drawn).

- The rental profits in this set-up are subject to corporation tax at 20% (falling to 17% in 2020).

- In this set-up, the mortgage interest is not subject to the mortgage interest relief clawback.

- Under the third set-up (Contractor Limited Company Buy-to-let), the particulars are as they are for the second set-up, above.

- Interestingly though, the deposit may be transferred between companies without incurring a tax liability.

Choosing the correct set-up for you is a good half of the battle won. However, if you are considering incorporating your existing rental properties or buying a property through a limited company, you will have to consider any impact or liability arising from the following:

- Capital Gains Tax

- Stamp Duty Land Tax (SDLT)

- Buildings Transaction Tax

- Inheritance Tax

- Corporation Tax

- Annual Tax on Enveloped Dwellings

Of all these, it is Stamp Duty that’s currently the most talked about. It should be highlighted that when transferring a property into a limited company, SDLT applies on the full market value of the property, and may apply to the aggregate value where more than one property is to be transferred.

As of last Friday (April 1st 2016), a surcharge of 3% came into force on the purchase of all buy-to-let properties with a value / purchase price of over £40,000. This levy applies at each marginal rate of SDLT. But similar to next year’s mortgage interest clawback, there is a legal solution to the problem of the SDLT hike, and shrewd property investors -- contractors included -- are understandably taking advantage of it. With either solution however, taking professional advice tailored to your circumstances is recommended before you proceed.