Business Account with ANNA Money

Managing your business account with ANNA Money means that you’ll have automatic tax calculations and tools for managing business admin, including invoicing, expenses, and VAT.

Why choose ANNA Money?

ANNA Money is here to provide contractors with an easy, simplified way of managing business finances. Being registered within minutes, you will instantly be able to use a virtual card, with your debit card being delivered in 3-5 days. With ANNA, you can expect:

- Speedy sign-up

Register in minutes.

- 24/7 support

ANNA’s award-winning customer service has a 45s response time.

- Smart integrations

Save time with e-seller platforms which sync transaction history with accounting software.

- Cashback on spending

Cashback on different business expenses.

- International payments

You can send and receive payment to and from over 180 countries.

- Easy expense management

Business bank accounts can be connected.

- Simplified sharing with your accountant or bookkeeper

Keep up to date with a live account feed.

What are the benefits of using ANNA Money?

Streamlined company formation

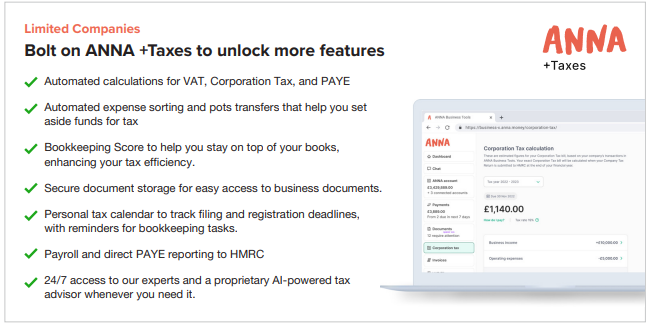

There are services available to help register your limited company, where all the paperwork is handled with Companies House. ANNA Money features an automated service to calculate VAT, PAYE, and Corporation Tax, so you can focus on business without worrying about the admin.

Automated tax filing

Managing taxes can be time-consuming when running a business. ANNA Money has automated tax services to calculate income, expenses, Corporation Tax, and VAT, helping you keep track of your obligations. These services remind you of the key deadlines, and in some cases can even file your taxes for you.

AI-Powered Tax Assistance

If you’re looking for quick and reliable answers to tax-related questions, AI-powered assistants can be a cost-effective alternative to hiring an accountant. They can handle a range of queries, like VAT calculations and filing deadlines, and because you’re not using an accountant for everyday questions, you can save money for when you need them for more complicated issues.